The issues raised are not confined to variable rate arrangements because a company can face difficulties where amounts subject to fixed interest rates or earnings mature at different times. This relates to the periods or durations for which loans (liabilities) and deposits (assets) last. The extra $400 relates to the mismatch of the borrowing and deposit of $20,000 x increase in SONIA of 2% = $20,000 x 2/100 = $400. The increase in interest paid has been almost exactly offset by the increase in interest received. The closer the two amounts the better.įor example, let’s say that the deposit rate of interest is SONIA + 1% and the borrowing rate is SONIA + 4%, and that $500,000 is deposited and $520,000 borrowed. This approach requires a business to have both assets and liabilities with the same kind of interest rate. The business would look at what it could afford, its assessment of interest rate movements and divide its loans or deposits as it thought best. There is no particular science about this. Looking at borrowings, if interest rates rise, only the variable rate loans will cost more and this will have less impact than if all borrowings had been at variable rate. In this simple approach to interest rate risk management the loans or deposits are simply divided so that some are fixed rate and some are variable rate. Similarly if a fixed rate deposit were made a business could be locked into disappointing returns. Although a fixed interest loan would protect a business from interest rates increases, it will not allow the business to benefit from interest rates decreases and a business could find itself locked into high interest costs when interest rates are falling and thereby losing competitive advantage. If fixed rates are available then there is no risk from interest rate increases: a $2m loan at a fixed interest rate of 5% per year will cost $100,000 per year. For example, variable rate might be set at SONIA +3%. Variable rates are sometimes known as floating rates and they are usually set with reference to a benchmark such as SONIA, the Sterling Overnight Index Average.

When taking out a loan or depositing money, businesses will often have a choice of variable or fixed rates of interest.

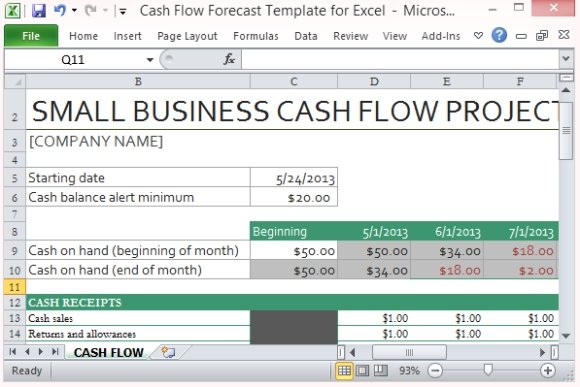

Traditional and basic approaches Matching and smoothing The primary aim is to limit the uncertainty for the business so that it can plan with greater confidence. Note carefully that the primary aim of interest rate risk management (and indeed foreign currency risk management) is not to guarantee a business the best possible outcome, such as the lowest interest rate it would ever have to pay. There is, of course, always a risk that if a business had committed itself to variable rate borrowings when interest rates were low, a rise in interest rates might not be sustainable by the business and then liquidation becomes a possibility. It will have less confidence in its project appraisal decisions because changes in interest rates may alter the weighted average cost of capital and the outcome of net present value calculations. If the business does not know its future interest payments or earnings, then it cannot complete a cash flow forecast accurately. (ii) how much interest they might earn on deposits, either already made or planned. (i) how much interest they might have to pay on borrowings, either already made or planned, or Interest rate risk arises when businesses do not know: Risk arises for businesses when they do not know what is going to happen in the future, so obviously there is risk attached to many business decisions and activities. (No numerical questions will be set on this topic) The cause of interest rate risk (b) Identify the main types of interest rate derivatives used to hedge interest rate risk and explain how they are used in hedging. (a) Discuss and apply traditional and basic methods of interest rate risk management, including: Section G of the Financial Management Study Guide specifies the following relating to the management of interest rate risk:

#Using offset to move cashflows professional

An introduction to professional insights.Virtual classroom support for learning partners.Becoming an ACCA Approved Learning Partner.

0 kommentar(er)

0 kommentar(er)